Home>Business and Finance>How To Get A Voided Check

Business and Finance

How To Get A Voided Check

Published: March 2, 2024

Learn how to get a voided check for business and finance purposes. Follow these simple steps to obtain a voided check for your financial needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Noodls.com, at no extra cost. Learn more)

Table of Contents

Introduction

Obtaining a voided check may seem like a simple task, but it holds significant importance in various financial and administrative processes. Whether you're setting up direct deposit for your paycheck, establishing automatic bill payments, or initiating electronic funds transfer, a voided check serves as a crucial document to validate your bank account details. In this comprehensive guide, we will delve into the intricacies of obtaining a voided check, shedding light on its significance and providing a step-by-step approach to acquire this essential financial instrument.

A voided check, often underestimated in its significance, plays a pivotal role in streamlining financial transactions. It serves as a tangible proof of your bank account information, including the account number and routing number, which are essential for electronic fund transfers. While the concept of a voided check may appear straightforward, its implications are far-reaching, impacting various facets of personal and business finance.

Understanding the nuances of obtaining a voided check is crucial for individuals and businesses alike. Whether you're a salaried employee seeking to set up direct deposit for your earnings or a business owner aiming to facilitate seamless electronic payments to vendors and suppliers, the process of obtaining a voided check is a fundamental step in ensuring the smooth flow of financial transactions. Moreover, comprehending the underlying reasons for needing a voided check can provide valuable insights into the interconnectedness of financial systems and the importance of accurate documentation in the digital age.

As we embark on this exploration, it's essential to recognize the practical significance of a voided check and the pivotal role it plays in modern financial operations. By unraveling the intricacies of obtaining a voided check and elucidating its multifaceted utility, we aim to empower individuals and businesses with the knowledge and guidance necessary to navigate the realm of financial documentation with confidence and proficiency.

What is a Voided Check?

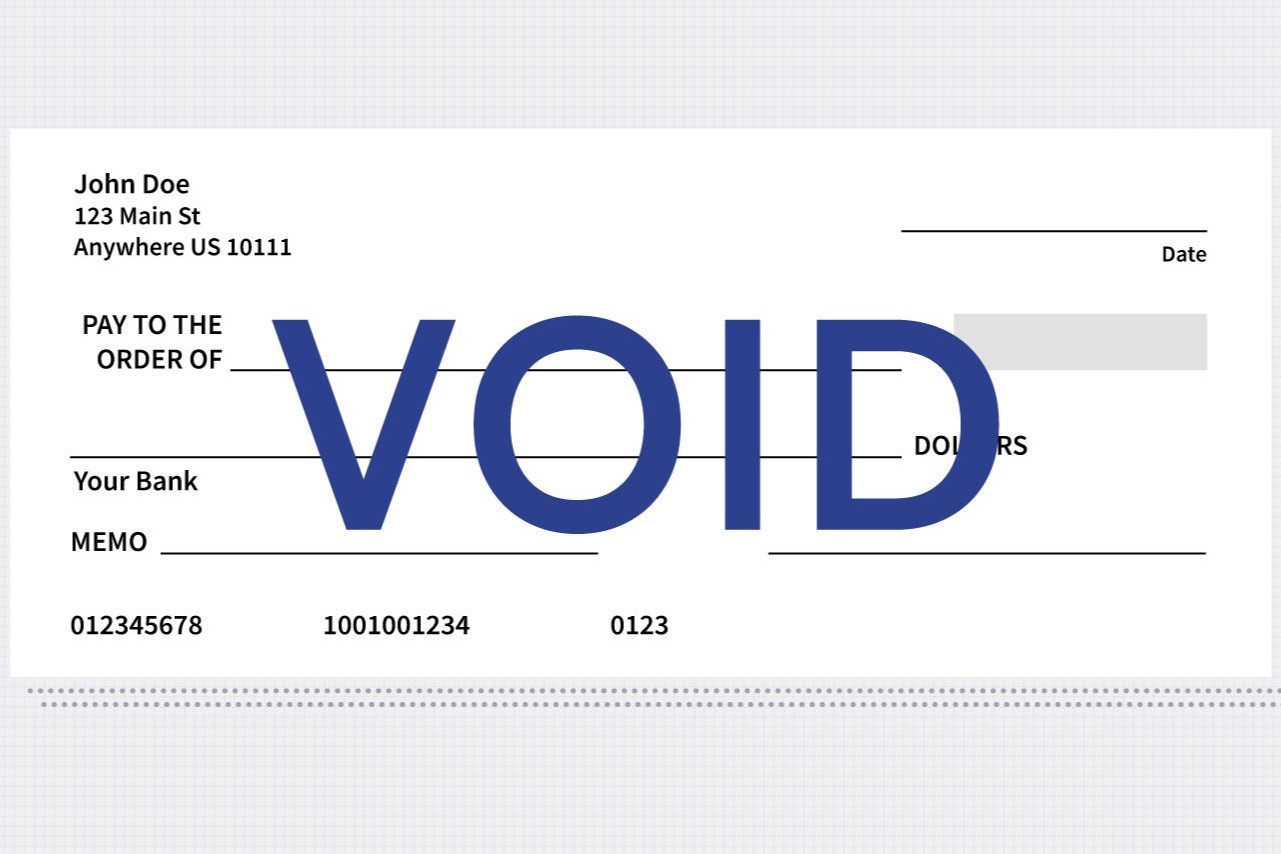

A voided check, in its simplest form, is a check that has been canceled or marked as void to render it unusable for financial transactions. While the term "voided" may evoke a sense of negation, a voided check holds substantial significance in the realm of banking and finance. It serves as a tangible representation of an individual or business entity's bank account details, including the account number and routing number, which are essential for facilitating electronic fund transfers and automated payments.

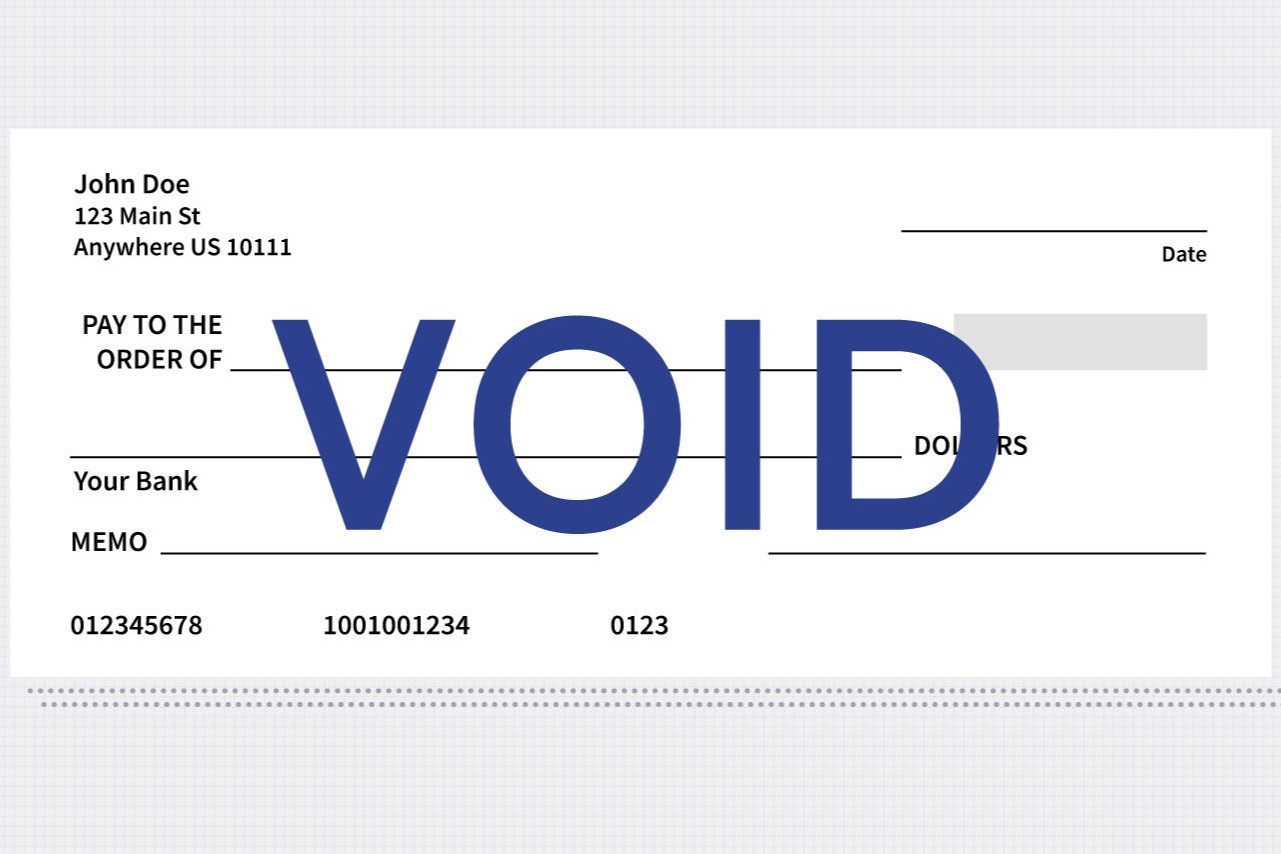

The process of voiding a check involves marking it with the word "VOID" in a prominent manner, typically across the front of the check. This act nullifies the check's validity for monetary transactions while retaining the crucial account information printed on it. The purpose of voiding a check is to safeguard the sensitive bank account details it contains, ensuring that they can be shared securely for various financial purposes without the risk of unauthorized use.

In essence, a voided check acts as a form of verification, providing concrete evidence of an individual or business's bank account information. This includes the account number, which uniquely identifies the specific account, and the routing number, which denotes the financial institution where the account is held. These details are vital for setting up direct deposit for payroll, initiating automatic bill payments, authorizing electronic fund transfers, and facilitating other forms of electronic transactions.

Moreover, a voided check serves as a practical solution for verifying bank account information without divulging sensitive details such as account statements or online banking credentials. Its role in expediting the establishment of electronic payment systems and financial arrangements cannot be overstated, making it an indispensable tool for individuals and businesses seeking to streamline their financial operations.

In summary, a voided check is not merely a defunct piece of paper; it is a potent instrument that encapsulates the essential bank account details required for electronic transactions. Its significance lies in its ability to validate and authenticate financial information, thereby enabling seamless and secure electronic fund transfers and payment processing. Understanding the pivotal role of a voided check is crucial for navigating the intricacies of modern banking and finance, empowering individuals and businesses to leverage this fundamental document effectively.

Why Do You Need a Voided Check?

A voided check serves as a foundational document in numerous financial scenarios, playing a pivotal role in expediting and validating electronic transactions. Its necessity stems from the fundamental requirement to securely and accurately verify bank account details for a myriad of financial activities. Understanding the specific reasons for needing a voided check sheds light on its multifaceted utility and underscores its indispensable nature in modern banking and finance.

Facilitating Direct Deposit:

One of the primary reasons for needing a voided check is to facilitate direct deposit of funds, particularly in the context of payroll processing. When setting up direct deposit for receiving salary or wages, employers often require a voided check to accurately capture the employee's bank account information. By providing a voided check, individuals enable their employers to seamlessly transfer funds directly into their bank accounts, eliminating the need for physical checks and expediting the payment process.

Establishing Automatic Bill Payments:

For individuals seeking to streamline their bill payment processes, a voided check is essential for establishing automatic payments. Whether it's for mortgage installments, utility bills, or subscription services, many companies and service providers offer the option to set up automatic withdrawals from a bank account. By submitting a voided check, individuals authorize these entities to initiate automated deductions, ensuring timely and hassle-free bill payments without the need for manual intervention.

Read more: Get What You Want Now With No Credit Checks Or Down Payments – Check Out These Online Stores!

Authorizing Electronic Fund Transfers:

In the realm of business finance, the need for a voided check arises when authorizing electronic fund transfers for various purposes. Whether it's initiating vendor payments, facilitating supplier transactions, or executing intercompany transfers, a voided check provides the necessary bank account details to validate and authenticate the electronic transfer of funds. This streamlined approach to financial transactions enhances operational efficiency and minimizes the reliance on traditional paper-based methods.

Verifying Bank Account Information:

Beyond specific financial transactions, a voided check serves as a reliable means of verifying bank account information without divulging sensitive details. When engaging in contractual agreements, lease arrangements, or financial partnerships, individuals and businesses may be required to provide proof of their bank account details. A voided check offers a secure and standardized method of validating this information, instilling confidence and trust in the accuracy of the provided banking credentials.

In essence, the need for a voided check transcends mere formality; it is deeply rooted in the practical requirements of modern financial operations. By serving as a conduit for direct deposit, automatic bill payments, electronic fund transfers, and account verification, a voided check emerges as an indispensable tool for streamlining financial processes and fostering seamless transactions. Its significance lies in its ability to validate and authenticate bank account details, thereby underpinning the efficiency and reliability of electronic financial interactions.

How to Get a Voided Check

Obtaining a voided check is a straightforward yet crucial process that requires attention to detail and adherence to specific guidelines. Whether you're an individual seeking a voided check for personal financial transactions or a business entity aiming to streamline electronic payments, the following steps outline the method for acquiring this essential document.

-

Locate Your Checkbook: The first step in obtaining a voided check is to locate your checkbook, which contains the personalized checks linked to your bank account. Ensure that you have access to a valid and unexpired checkbook, as the information printed on the check will be used to generate the voided check.

-

Select a Blank Check: Once you have your checkbook at hand, identify a blank check that you can use to create the voided check. It's important to choose a check that is not already designated for a specific payment, ensuring that the voided check does not interfere with any pending transactions.

-

Mark the Check as Void: Using a pen or marker with dark ink, prominently write the word "VOID" across the front of the selected check. Ensure that the word is clearly legible and covers a significant portion of the check, indicating that it is no longer valid for financial transactions.

-

Retain the Voided Check: After marking the check as void, it's essential to retain it for your records. While the voided check cannot be used for payments or deposits, it serves as a tangible representation of your bank account details and may be requested in various financial scenarios.

-

Provide the Voided Check as Needed: Once you have obtained the voided check, be prepared to present it as needed for setting up direct deposit, authorizing automatic payments, or facilitating electronic fund transfers. Whether it's for employment purposes, bill payments, or business transactions, the voided check serves as a crucial validation of your bank account information.

By following these steps, individuals and businesses can effectively obtain a voided check to support a wide range of financial activities. It's important to handle the voided check with care and discretion, recognizing its significance in validating bank account details and expediting electronic transactions.

In summary, the process of obtaining a voided check entails selecting a blank check from your checkbook, marking it as void, and retaining it for future use. This simple yet essential procedure empowers individuals and businesses to harness the utility of a voided check in navigating the intricacies of modern financial transactions.

Conclusion

In conclusion, the significance of a voided check transcends its seemingly mundane nature, encompassing a pivotal role in the realm of modern banking and finance. As we've delved into the intricacies of obtaining a voided check and elucidated its multifaceted utility, it becomes evident that this seemingly simple document holds profound implications for individuals and businesses alike.

The process of obtaining a voided check, as outlined in this guide, underscores the practicality and necessity of this financial instrument. From facilitating direct deposit and automatic bill payments to authorizing electronic fund transfers and verifying bank account information, the voided check serves as a linchpin in expediting and validating electronic transactions. Its role in streamlining financial processes and fostering seamless interactions underscores its indispensable nature in the digital age.

Moreover, the act of voiding a check, while rendering it unusable for monetary transactions, preserves the crucial bank account details it contains, safeguarding sensitive information while enabling secure validation for various financial activities. This balance between security and utility underscores the nuanced significance of a voided check as a tangible representation of an individual or business entity's banking credentials.

As individuals and businesses navigate the complexities of financial documentation and electronic transactions, the knowledge and guidance provided in this guide empower them to approach the process of obtaining a voided check with confidence and proficiency. By understanding the practical reasons for needing a voided check and mastering the method for acquiring this essential document, individuals and businesses can harness its utility to streamline their financial operations and foster efficient electronic interactions.

In essence, the journey of obtaining a voided check encapsulates the convergence of practicality, security, and efficiency in the realm of modern finance. By recognizing the pivotal role of a voided check and embracing its multifaceted utility, individuals and businesses can navigate the digital landscape of financial transactions with clarity and assurance, leveraging this fundamental document to facilitate seamless and secure electronic fund transfers, payment processing, and account validation.

Ultimately, the voided check stands as a testament to the interconnectedness of financial systems, the importance of accurate documentation, and the seamless integration of technology in modern banking and finance. As individuals and businesses embrace the significance of this essential document, they embark on a journey of financial empowerment, equipped with the knowledge and tools necessary to navigate the intricacies of electronic transactions with precision and confidence.